Credit Risk - Logistic Regression Model in R

To build our first model, we will tune Logistic Regression to our training dataset.

First we set the seed (to any number. we have chosen 100) so that we can reproduce our results.

Then we create a downsampled dataset called samp which contains an equal number of Default and Fully Paid loans. We can use the table() function to check that the downsampling is done correctly.

1> set.seed(100)

2> samp = downSample(data_train[-getIndexsOfColumns(data_train, c( "loan_status") )],data_train$loan_status,yname="loan_status")

3> table(samp$loan_status)

4 Default Fully.Paid

5 12678 12678

6>

7We will now choose a small set of data for tuning the model.

1#choose small data for tuning

2train_index = createDataPartition(samp$loan_status,p = 0.05,list=FALSE,times=1)

3We will use the functions available in the caret package to train the model.

Step 1: We setup the control parameter to train with the 3-fold cross validation (cv)

1ctrl <- trainControl(method = "cv",

2 summaryFunction = twoClassSummary,

3 classProbs = TRUE,

4 number = 3

5 )

6Step 2: We train the classification model on the data

1glmnGrid = expand.grid(.alpha = seq(0, 1, length = 10), .lambda = 0.01)

2glmnTuned = train(samp[train_index,-getIndexsOfColumns(samp,"loan_status")],y = samp[train_index,"loan_status"],method = "glmnet",tuneGrid = glmnGrid,metric = "ROC",trControl = ctrl)

3Advanced Notes

We use Elastic Net regularization, which comprises of Ridge and Lasso regularization, with cross-validation to prevent overfitting. Our goal is maximizing AUC. Learn more about Regularization here.

Due to limited computation resource, we run model tuning on small data and fixed lambda parameter. We use small fold: 3-fold cross validation. We then refit the best model with the whole data.

(Note: we put the final tuning result here instead of running through the whole process. We disable the execution of tuning code although readers can enable it back by setting eval = TRUE )

Look Inside glmTuned

We can now examine the output of the generated model.

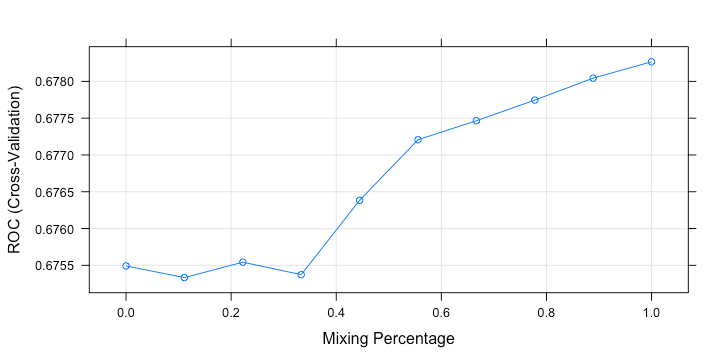

plot(glmnTuned)

1> glmnTuned

2glmnet

31268 samples

4 70 predictor

5 2 classes: 'Default', 'Fully.Paid'

6No pre-processing

7Resampling: Cross-Validated (3 fold)

8Summary of sample sizes: 846, 844, 846

9Resampling results across tuning parameters:

10 alpha ROC Sens Spec

11 0.0000000 0.6754917 0.6261588 0.6261215

12 0.1111111 0.6753332 0.6245939 0.6261215

13 0.2222222 0.6755427 0.6293332 0.6340055

14 0.3333333 0.6753729 0.6277609 0.6371725

15 0.4444444 0.6763833 0.6277609 0.6356002

16 0.5555556 0.6772067 0.6277609 0.6387523

17 0.6666667 0.6774650 0.6230290 0.6387746

18 0.7777778 0.6777457 0.6214567 0.6372023

19 0.8888889 0.6780438 0.6230365 0.6372023

20 1.0000000 0.6782664 0.6277758 0.6356300

21Tuning parameter 'lambda' was held constant at a value of 0.01

22ROC was used to select the optimal model using the largest value.

23The final values used for the model were alpha = 1 and lambda = 0.01.

24>

25The best penalty parameter is alpha = 1 (more weight on Ridge) with fixed shrinking lambda = 0.01. We use this parameter to retrain the whole sample.

1library(glmnet)

2model = glmnet(

3 x = as.matrix(samp[-getIndexsOfColumns(samp,"loan_status")]),

4 y=samp$loan_status,

5 alpha = 1,

6 lambda = 0.01,

7 family = "binomial",

8 standardize = FALSE)

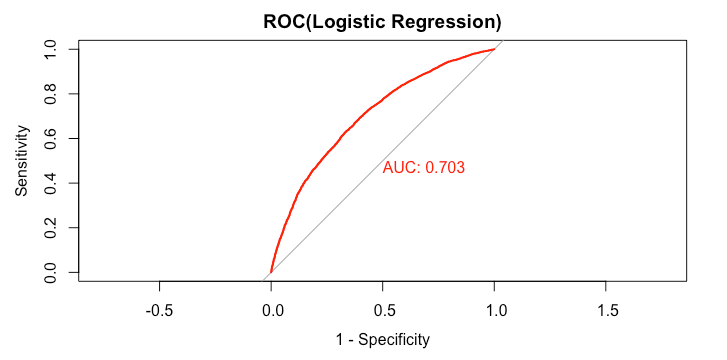

9The finalized Logistic Regression model is applied to the test loan data. We look at ROC graph and AUC. We also set probability prediction cutoff at 50% (noted that the higher this value is, the more likely the loan is Fully Paid) and collect some performance metrics for a later comparison.

1table_perf = data.frame(model=character(0),

2 auc=numeric(0),

3 accuracy=numeric(0),

4 sensitivity=numeric(0),

5 specificity=numeric(0),

6 kappa=numeric(0),

7 stringsAsFactors = FALSE

8 )

91predict_loan_status_logit = predict(model,newx = as.matrix(data_test[-getIndexsOfColumns(data_test,"loan_status")]),type="response")

2ROC and AUC

1library(pROC)

2rocCurve_logit = roc(response = data_test$loan_status,

3 predictor = predict_loan_status_logit)

4auc_curve = auc(rocCurve_logit)

51plot(rocCurve_logit,legacy.axes = TRUE,print.auc = TRUE,col="red",main="ROC(Logistic Regression)"

2

1> rocCurve_logit

2Call:

3roc.default(response = data_test$loan_status, predictor = predict_loan_status_logit)

4Data: predict_loan_status_logit in 5358 controls (data_test$loan_status Default) < 12602 cases (data_test$loan_status Fully.Paid).

5Area under the curve: 0.7031

6>

71> predict_loan_status_label = ifelse(predict_loan_status_logit<0.5,"Default","Fully.Paid")

2> c = confusionMatrix(predict_loan_status_label,data_test$loan_status,positive="Fully.Paid")

3> table_perf[1,] = c("logistic regression",

4 round(auc_curve,3),

5 as.numeric(round(c$overall["Accuracy"],3)),

6 as.numeric(round(c$byClass["Sensitivity"],3)),

7 as.numeric(round(c$byClass["Specificity"],3)),

8 as.numeric(round(c$overall["Kappa"],3))

9 )

10> rm(samp,train_index)

11> tail(table_perf,1)

12 model auc accuracy sensitivity specificity kappa

131 logistic regression 0.703 0.645 0.643 0.65 0.256

14>

15