Weighted Average Cost of Capital (WACC)

Test Your Knowledge

Check your understanding of this lesson with a short quiz.

Check your understanding of this lesson with a short quiz.

Ask questions about this lesson and get instant answers.

The cost of capital is the rate of return that a firm pays to bondholders and equity holders. Cost of capital is an important measure while making investment decisions, as any one making an investment would expect a higher return from his investment in a company compared to what he could earn from an alternative investment with equivalent risk.

A company raises capital in many forms such as common equity, preferred equity, debt and other instruments. The cost of each of these components of funding is called component cost of capital.

The cost of capital for the entire company averages out the cost of capital from all these components.

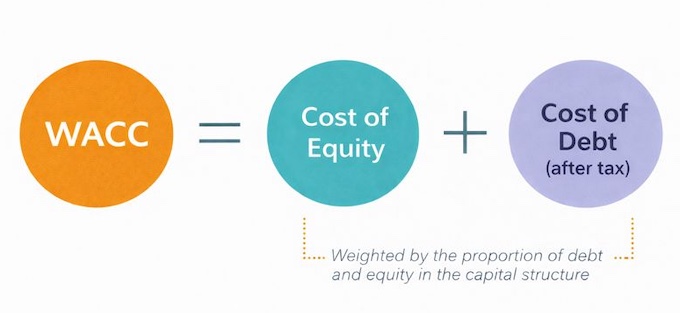

The Weighted Average Cost of Capital (WACC) is the average cost a company pays for its financing, weighted by the proportion of each capital source in its capital structure. It represents the minimum return that a company must earn on its investments to satisfy all its investors: debt holders, preferred stockholders, and common equity holders. WACC is also called the Marginal Cost of Capital (MCC) since it represents the cost of raising one additional dollar of capital.

WACC is calculated using the following formula:

Where,

In the above formula refers to after-tax cost of debt. In many countries, the interest payments on the debt are tax deductible. We are interested in calculating the after-tax cost of capital. Therefore, the cost of debt is adjusted for the marginal tax rate paid by the company. There is no tax deduction benefit for preferred and common stock.

Example

Let’s assume that a company has the following capital structure:

| Weight | Cost | |

|---|---|---|

| Equity | 50% | 20% |

| Preferred Stock | 20% | 12% |

| Debt | 30% | 8%* |

Assuming a marginal tax rate of 30%, the Weighted Average Cost of Capital is calculated as follows:

WACC = 0.30*0.08 (1-30%) + 0.20*0.12 + 0.50*0.20

= 14.08%

There are certain nuances of calculating WACC that analysts must be aware of, which we will discuss in the next article.