Lesson Downloads

Marginal Cost of Capital (MCC) Schedule

Test Your Knowledge

Check your understanding of this lesson with a short quiz.

Check your understanding of this lesson with a short quiz.

Ask questions about this lesson and get instant answers.

MCC Schedule is a graph that relates the firm’s weighted average of each dollar of capital to the total amount of new capital raised.

It reflects changing costs depending on amounts of capital raised. As more funds are raised, the cost of various sources of capital can change because of various reasons:

The firm may have existing debt with a bond covenant that restricts the company from issuing debt with similar seniority as existing debt.

Debt incurrence test may restrict a company ’ s ability to incur additional debt at the same seniority based on one or more financial tests or conditions.

As the company experiences deviations from the target capital structure, the marginal cost of capital may increase, reflecting these deviations.

An additional amount of capital that changes the WACC is referred to as a break point. This is the point at which the cost of one of the sources of capital changes.

The break point is calculated using the following formula.

Break Point = Amount of Capital at which Sources Cost of Capital Changes/Proportion of New Capital Raised from the Source

Example

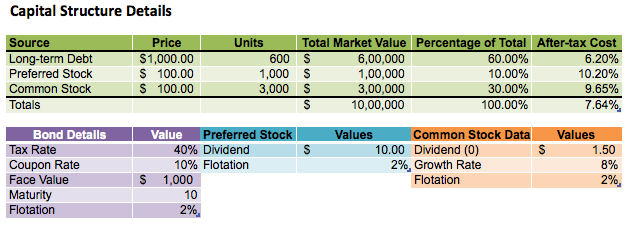

The following capital structure data is available:

The MCC schedule will look as follows: