Solvency Ratios

Test Your Knowledge

Check your understanding of this lesson with a short quiz.

Check your understanding of this lesson with a short quiz.

Ask questions about this lesson and get instant answers.

Solvency ratios measure a business’s ability to meet its obligations in the long-term based on its overall debt level and earnings capacity. These ratios are important because failure to meet its interest obligation could put a firm into bankruptcy. They are also called leverage ratios. Solvency ratios include debt ratios and coverage ratios.

This ratio measures what percentage of assets is financed with debt. An increase in this ratio indicates that the company is relying more on debt as a source of financing its assets. A decrease in this ratio indicates less reliance on financing.

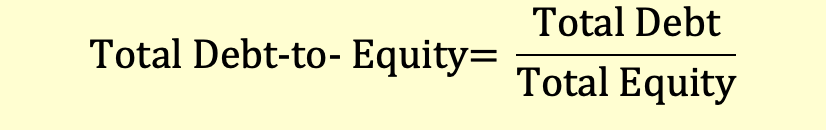

This ratio shows the extent the company is leveraged. If the company has too much debt, any dip in business may result in the owner losing its equity or put the company in a position wherein it cannot service its debt. Alternatively, if the debt quotient is small, it probably means the company is not putting enough capital to work.

Factors that affect this ratio are:

Debt-to-capital ratio is the ratio of total debt to total capital.

A high debt-to-capital ratio indicates that a high proportion of a company's capital is comprised of debt which makes it riskier for the shareholders.

Also called leverage ratio, this ratio measures the financial leverage of a company.

A higher financial leverage indicates more usage of debt, and higher risk for shareholders as well as bondholders. While analyzing this ratio, it is important to understand what kind of business the firm is in. A fairly steady company can probably take on large amounts of debt without too much risk. On the other hand for a company in a cyclical business an investor should be vary of a high leverage ratio. A financial leverage ratio of 2.1 is fairly conservative, even for a fast growing retailer. It’s when we see ratios of 4, 5 or more that companies start to get really risky.

However, financial firms and banks have a much larger asset base relative to equity. The average bank has a financial leverage ratio in the range of 12 to 1 or so, as compared to 2-to-1 or 3-to-1 for the average company.

Interest coverage ratio, also called ‘Times Interest Earned’, determines a firm’s ability to repay its debt obligations.

The ratio indicates how many times the company could have paid the interest expense on its debt. The higher the ratio, the less likely that the company will run into difficulty if earnings fall unexpectedly. Companies in more volatile businesses will have a higher interest coverage ratio than stable companies. An analyst should look for the trend in the interest coverage ratio for a period of time. A falling interest coverage ratio over time indicates that the company is becoming riskier.

This ratio indicates the company’s ability to meet its fixed financing expenses such as interest and lease payments.

This is a more useful measure for companies that lease a large part of their assets such as airline companies. The higher the ratio, the easier it is for the company to meet these obligations.