Principles of Strategic Analysis

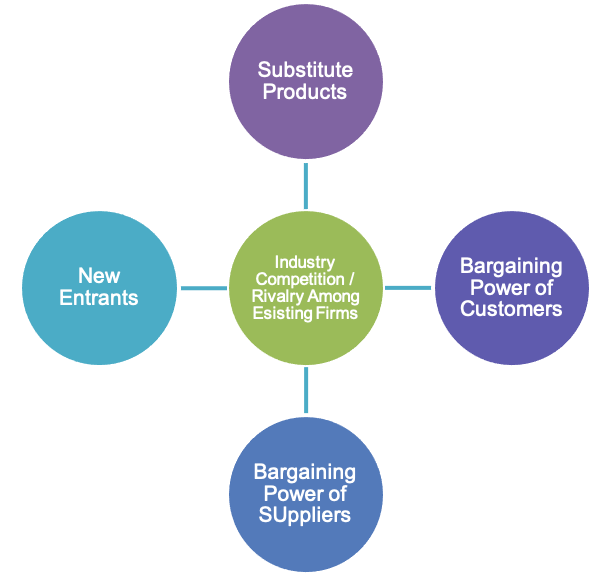

Strategic analysis studies the impact of the competitive environment in the shaping of corporate strategy. Michael Porter's five forces theory is used extensively for this analysis.

Porter's theory says there are five factors that determine the competitive environment of an industry.

- Substitute products: If a substitute product meets a customer's needs, it adversely affects the industry of the original market. An example of this is the cheap imitation of a high-end designer dress in the local market. Another example is that of customers choosing generic brands of staple products rather than branded products in the same category. This prevents the segment from raising prices and finding real elements to distinguish it from the substitutes.

-

Bargaining power of customers: When the number of customers is small in number but with substantial buying capacity, their bargaining power is very high. Customers will bargain for better prices and higher quality.

-

Bargaining power of suppliers: In other cases the number of suppliers may be restricted and therefore have greater power in terms of how much they supply and to whom.

-

New entrants: Industries with high margins will attract new players. The key factor that determines this is the barrier to entry. For example while the margins in the chip making industry may be attractive, so are the levels of expertise required to set up a plant and the capital investment required.

-

Intensity of rivalry: Industries that have a large number of players tend to be characterised by high fragmentation, low margins, high fixed costs and high exit barriers.

Analysts assessing an industry therefore will need to look at the following points while conducting a thorough strategic analysis.

-

What are the barriers to entry? Are they low or high?

-

Is the industry dominated by a few players or filled with many? What is the size of market share they control?

-

Does the industry have a balanced demand and supply situation? What is its capacity situation?

Test Your Knowledge

Check your understanding of this lesson with a short quiz.