Industry Life Cycle

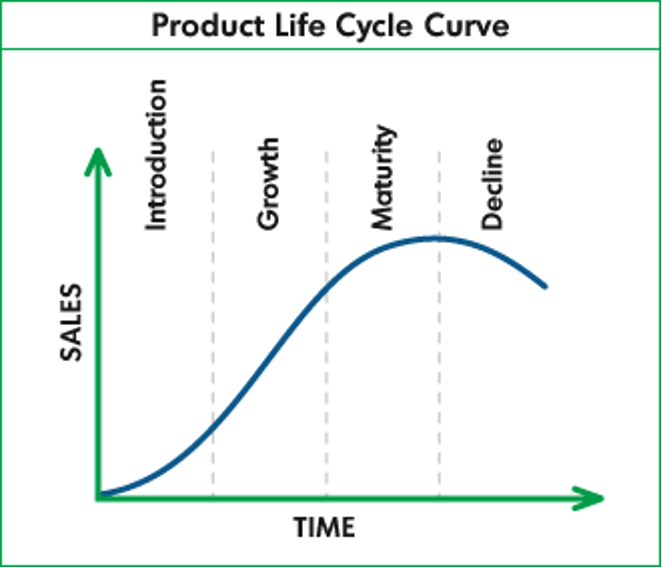

The Industry Life Cycle is a critical tool for analyst to assess industries. Individuals have a birth, infancy, growing years (childhood and teenage), young adulthood, mature years (middle age) and the declining years of old age. An Industry's life cycle is comparable to that of a person. Let us understand it in a little more detail.

Introduction: This is an industry in its nascent stage. It is characterised by high prices, low growth and economies of scale that are not financially viable. Product awareness and distribution network are low at this stage. A high level of investment is also required, without which they will fail.

Growth: Industries in this stage are characterised by rapidly increasing demand, falling prices, increasing profitability and low demand. There is increasing demand for the products due to new customers. Some competition may be faced, but since the market is open there is space for it. It is also characterised by improved economies of scale.

Shakeout: is characterised by slowing growth, intense competition and reducing profitability. Market demand is usually at saturation point, with fewer newer customers. Price cutting usually takes place to maintain if not increase growth rates. Companies take a relook at their costs and branding. As the stage's name suggests companies that continue to show diminishing profitability may exit the industry altogether.

Mature: This stage is characterised by a kind of stagnation, with no new growth, consolidation and high barriers to entry. The market gets saturated and soon there are only a few large players that exist in the market.

Decline: This stage is characterised by negative growth, low demand and therefore increased inventory in many cases. The returns from such companies can be expected to do a downturn.

So what use is an industry life cycle to an analyst?

An analyst will use the industry life cycle as a reference tool to check if the company under evaluation is showing the traits of the stage it is in. If it is found that a company in it's shakeout stage is not consolidating its position with better promotions and advertising or building on capacity, an analyst may rethink about investing in it.

Limitations of a product life cycle could include the fact that a company may not go through a predicatble life cycle. New technological developments could mean a company in it's growing years will go straight to its declining stage. Government regulations, social factors and changing demographics can change the way the life cycle of a company looks. Furthermore all companies in an industry may have very different life cycles based on the things they do to increase revenues and profitability.

Test Your Knowledge

Check your understanding of this lesson with a short quiz.