Classification of Financial Markets

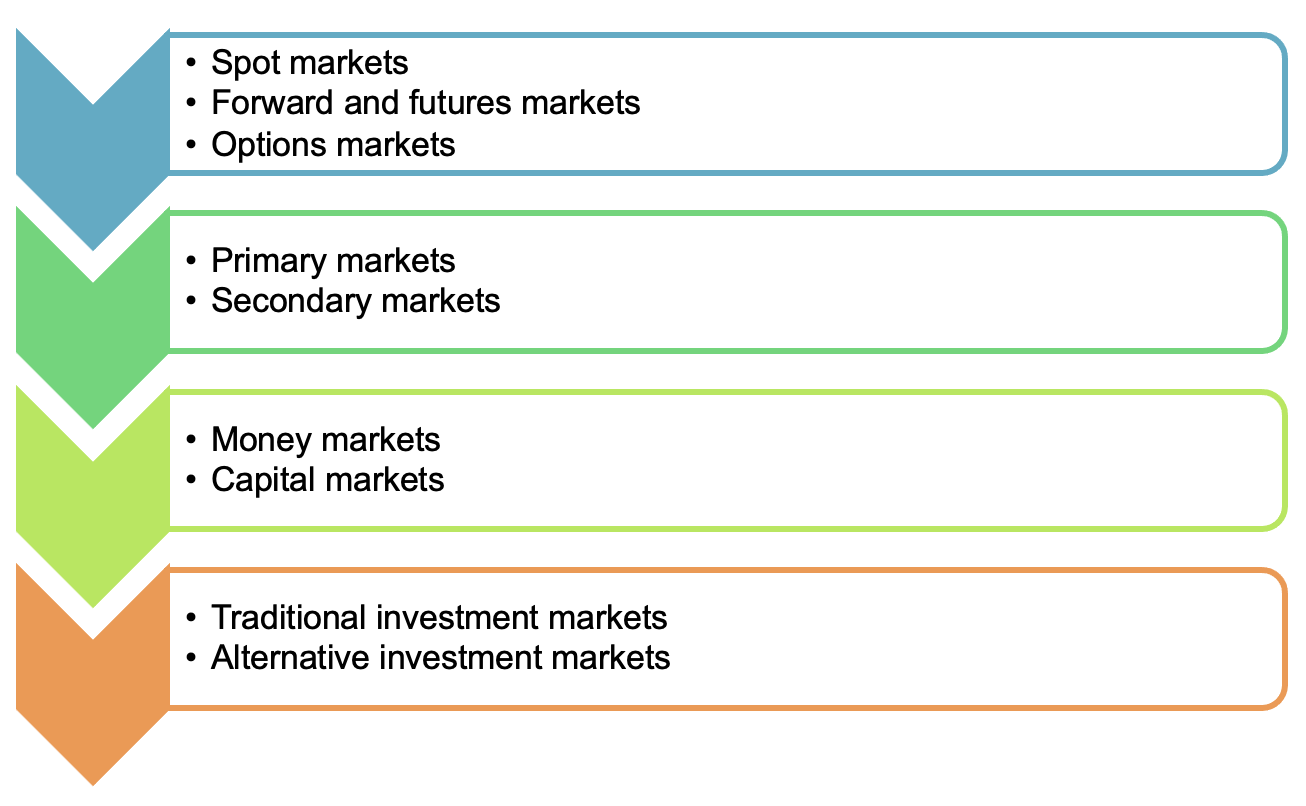

There are many ways to classify financial markets:

The first classification is based on the time of delivery. In the spot markets assets are traded for immediate delivery. In the forward and futures markets, assets are traded for future delivery. Even in options markets, assets are traded for future delivery but delivery is contingent on the option being exercised.

Another way to classify markets is as primary and secondary markets. In the primary markets, issuers sell securities to the investors. In the secondary markets, investors trade securities with other investors.

We can also classify markets based on the maturity of instruments traded in it. In the money markets, debt instruments with one year or less maturity are traded. Capital market is a broad terms referring to markets where long-term instruments such as equities and bonds are traded.

Traditional investments include investments such as publicly traded stocks, bonds, and mutual funds. Alternative investments include hedge funds, private equities, venture capital, commodities, real estate, securitized debts, collectibles, precious gems, etc.

Additional Readings for this course:

Equity Market Organization and StructureThe Stock Market

Test Your Knowledge

Check your understanding of this lesson with a short quiz.