Classification of Assets in Financial Markets

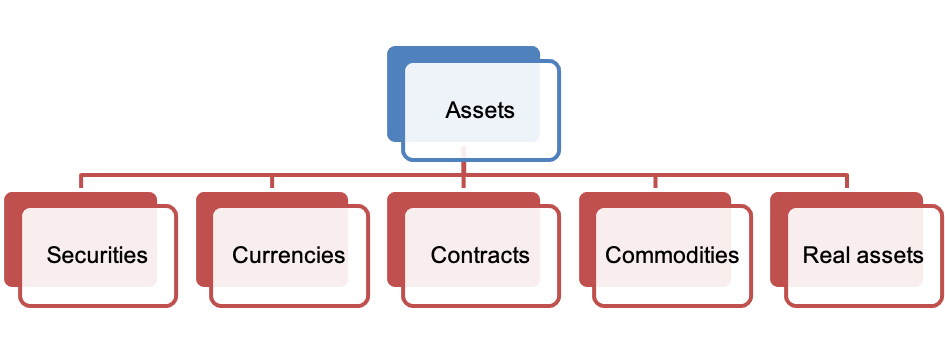

The various assets traded in the financial markets are classified as follows:

Securities represent ownership (stocks) or a debt agreement (bonds). They include equities, fixed income, and pooled investments and may also be classified as either public or private.

Currencies are monies issued by national monetary authorities; approximately 175 currencies are currently in use throughout the world.

A reserve currency is a currency that is held in significant quantities by many governments and institutions as part of their foreign exchange reserves. It also tends to be an international pricing currency for products or commodities traded in the global market. Primary reserve currencies are the U.S. dollar and the euro.

A contract is an agreement among traders to do something in the future. Contracts include forward, futures, swap, option, and insurance contracts. The values of most contracts depend on the value of an underlying asset. The underlying asset may be a commodity, a security, an index representing the values of other instruments, a currency pair or basket, or other contracts.

Commodities include precious metals, energy products, industrial metals, agricultural products, and carbon credits.

Real assets include such tangible properties as real estate, airplanes, machinery, or lumber stands.

All these assets are discussed in detail in their respective readings.

Test Your Knowledge

Check your understanding of this lesson with a short quiz.