Lesson Downloads

Real Estate Valuation: Part 2 (Income Approach)

In Real Estate Valuation Part 1 we discussed the complexity of valuing real estate. VIP Realty discussed two of four approaches of real estate valuation. They were the cost approach and sales comparison approach. In this part, we will discuss the Income Approach for valuing real estate.

The Income Approach: This approach treats the net operating income or NOI from the property as perpetuity. This perpetual stream is discounted at a market required rate of return and is known as the market capitalization rate or cap rate. Market cap rate is the rate that is used by the market in recent transactions to capitalize future income into a present market value.

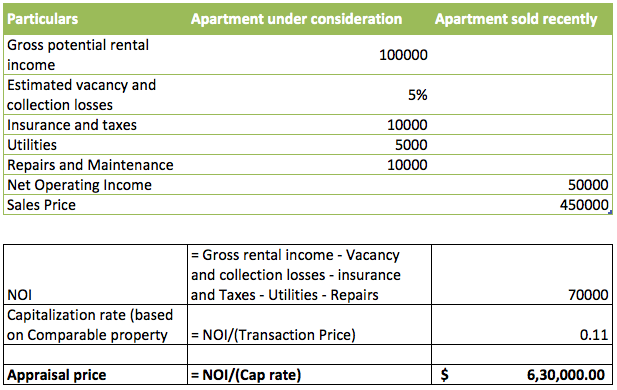

NOI= Gross Potential Income – Expenses (estimated vacancy, collection losses, insurance, tax, utilities, repairs and maintenance)

Appraisal Price= NOI/ Market rate cap

The market rate cap on benchmark transactions are:

Market rate cap= Benchmark NOI/Benchmark transaction price.

The benchmark here refers to a similar/comparable property, or the mean or median of many comparable properties.

The income approach assumes a constant and perpetual stream of income from the property. Inflation could impact the NOI over time in the sense that the NOI would grow at the rate of inflation. The market cap rate accounts for inflation. Since inflation is passed through, valuation stays unaffected. This is however not true for spaces on lease. Lease periods do not allow for inflation to be passed through on an annual basis. In the income approach all calculations are before tax, which is a limitation.

Example

A property holder wants to sell his apartment complex. He learns that a commercial building and another apartment in the vicinity were recently sold. Using the income approach, the value of the apartment complex can be calculated as follows:

We use the actual cost and not financing cost when we calculate NOI. Depreciation is not deducted, assuming repairs and maintenance will keep the building in good condition.